CGA by Nielsen IQ has released its bi-monthly US On-Premise Impact Report, which covers Halloween, cost of living increases, and consumer plans to visit the on-premise.

From October 12-13, CGA by NIQ surveyed 1,604 respondents from Florida, Texas, California, and New York on their expectations, desires, and how they plan to behave in the next two weeks. Consumers had to have visited the on-premise in the past 3 months.

Consumer Feelings on Visiting the On-Premise

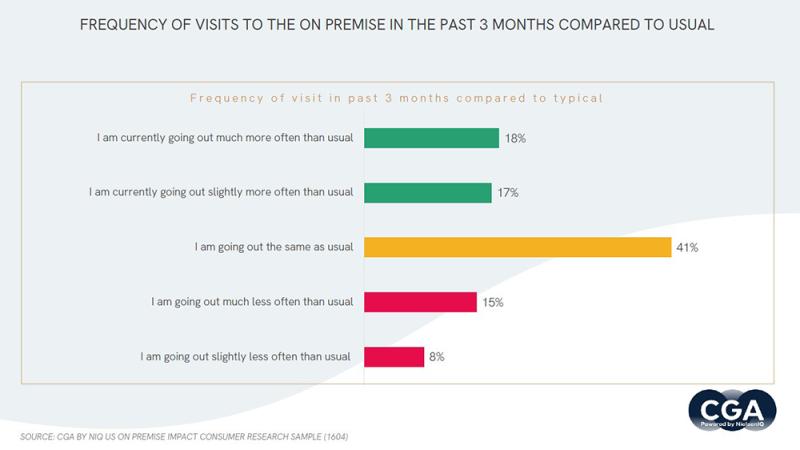

On-premise visitation is almost static among those visiting the channel, with 46% of respondents saying they had visited the on-premise in the last week and 43% saying they plan to make their visit within a week. The majority of respondents (41%) also explicitly stated that they are going out the same as usual. This trend doesn’t look to change any time soon as most consumer respondents said they plan to visit hospitality venues the same amount through the end of 2022, with 36% of respondents saying they plan to spend the same one eating and drinking out over the next month.

Satisfaction with service received on visits continues to be extremely positive with 87% saying they were satisfied or very satisfied with the quality of service. However, in comparison, only 70% of respondents responded that they were satisfied with the value for their money.

This is indicative of the effects of inflation. While visits to the on-premise have remained pretty stable, 23% of respondents did indicate they are visiting less, primarily due to the increase in the prices of food and drink and the cost of living.

Among those spending less on visits to the on-premise, they are twice as likely to be choosing cheaper food options (34%) than cheaper drink options (16%). In fact, 70% of respondents say there has been no change in the quality of drinks they order. This points to the continued popularity of premiumization, which remains high despite economic stressors. Of the drinks being ordered, soft drinks and beer led the way. Coffee came in third, which proves the popularity of coffee and coffee cocktails isn’t waning.

Even as costs rise, there is clear evidence of the importance of the on-premise to many consumers, with a quarter saying they would prioritize regular visits out, even if their disposable income goes down in the next 12 months.

Halloween

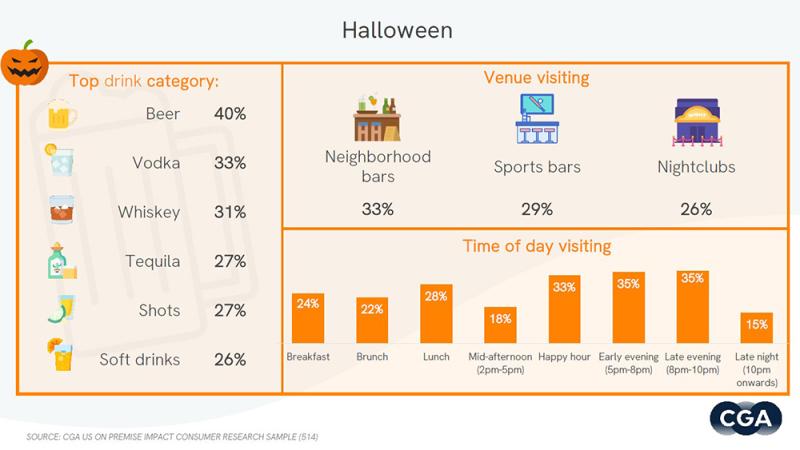

For a look at the more immediate future, CGA by NIQ asked survey respondents if they would be visiting the on-premise to celebrate Halloween, and 32% said yes. To celebrate the holiday, consumers are planning to drink a lot of beer (40%), followed by vodka (33%), and whiskey (31%).

Most consumers plan to visit the on-premise in the evening, with neighborhood bars being the most popular choice followed by sports bars in a close second.

Other Events

As for other leading October events, 31% of consumers attended an Oktoberfest event, with flavored beer leading the order selections.

Not as popular with consumers were Sober October options, with 61% saying they did not or would not take part in it. This seems to be driven more by a lack of awareness versus a lack of interest in non-alc as of that 61%, 37% had not heard of the October observation before.

Plan to Attend or Participate in the Vibe Conference, Feb. 27 – March 1, 2023

To learn more about the latest trends, issues and hot topics, and to experience and taste the best products within the on-premise beverage community, plan to attend the Vibe Conference, Feb. 27 to March 1, 2023 at the Sheraton San Diego Hotel & Marina. Visit VibeConference.com.

To book your sponsorship or exhibit space at the Vibe Conference, contact:

Fadi Alsayegh Sales & Sponsorships Email: [email protected] Phone: 917-258-5174

Donna Bruns Sales & Sponsorships Email: [email protected] Phone: 936-522-6932

Charlie Forman Sales & Sponsorships Email: [email protected] Phone: 845-262-1041

Connect and follow Questex’s Vibe Conference and community at Facebook and LinkedIn.