The results are in from our 2024 State of the Industry Survey.

Nearly 275 industry members participated in the survey, with the majority being owners/presidents/CEOs (27.74%) and general managers (14.96%). A large number of restaurants participated, with 28.83% chain restaurants and 23.36% independent restaurants making up the respondents. Bars had a strong showing as well at 18.98% of participants.

Coming off of a year marked by continued staff challenges and rising costs, operators said their biggest wins in 2023 were staying open, providing great customer service, and staff and customer retention.

Investing Plans

Despite inflation and rising costs, survey respondents are hopeful about the economy in 2024, as 39.42% say they expect it to improve marginally and 27.37% expect it to remain stable.

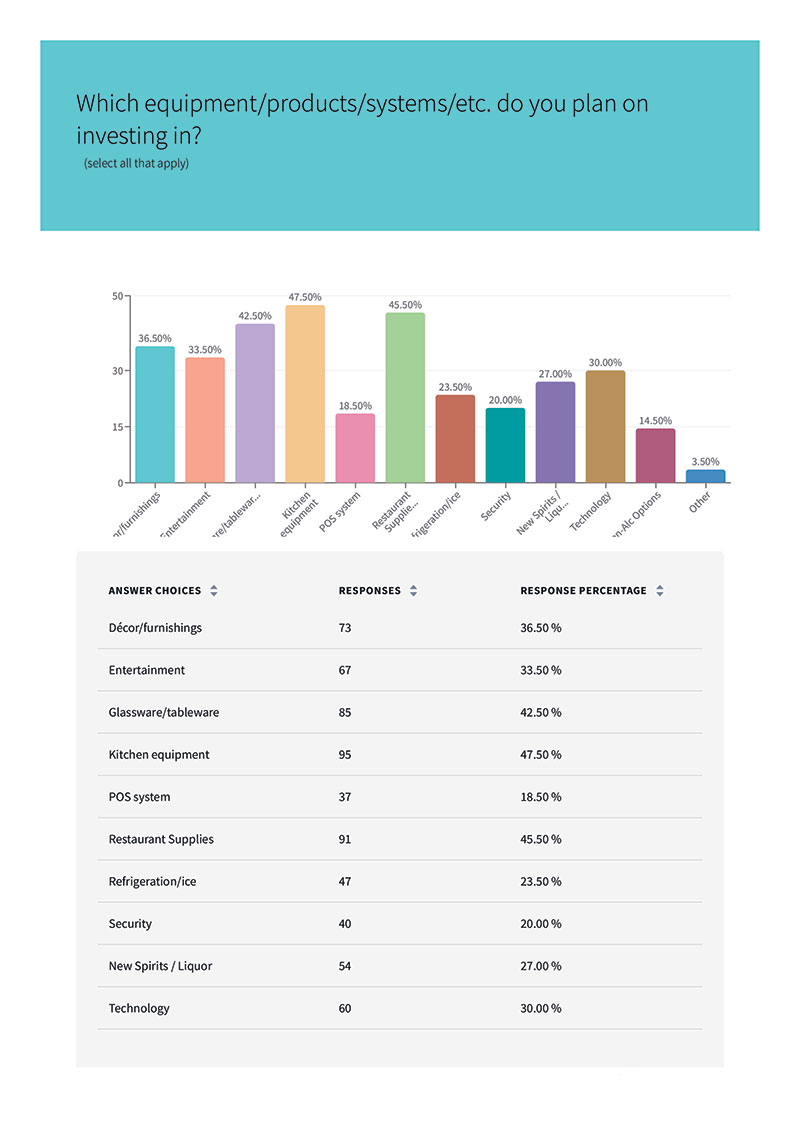

Given this outlook, a decisive majority of respondents said they are planning on investing in new equipment or upgrades in 2024 (72.99%). Most plan on spending between $10-15,000 on investments (35.18%), with just over 27% planning on spending more than $20,000.

The top areas slated for investment are kitchen equipment (47.5%), restaurant supplies (45.5%), and glassware/tableware (42.5%).

AI Advances

Many survey respondents also said they are planning to invest in technology (30%), of which artificial intelligence (AI) is playing a growing role. In fact, over 62% said they are already using AI or exploring their options for adding it to their bar or restaurant.

While the hospitality industry is using AI in much of the same ways as other industries—to streamline processes—Michael Spataro, chief customer officer at Legion Technologies, creator of a workforce management platform that utilizes AI, says the bar and restaurant industry is uniquely positioned to take advantage of AI given the hands-on, labor-intensive nature of the industry.

“The bar and restaurant experience is grounded in human interaction—servers and bartenders liaising with customers, as well as collaborating with one another—and AI enables these employees to focus more intently on this part of the job,” says Spataro. “For example, an AI-native scheduling system can reduce friction around shift-swapping and callouts while relieving managers of the time-consuming, mundane task of creating schedules manually.

"Generative AI also has the potential to revolutionize daily operations, as natural language processing applications can offer swift feedback on training, compliance, and employee schedules. By reducing time spent on tedious administrative tasks, AI empowers bar & restaurant employees and managers to concentrate on delivering an enhanced customer experience.”

Challenges Facing Bars & Restaurants in 2024: Rising Costs

Costs have been rising and so have industry wages. In fact, 63.5% said they have raised wages, while another 25% said they are considering raising them or higher wages are soon to be mandated in their state.

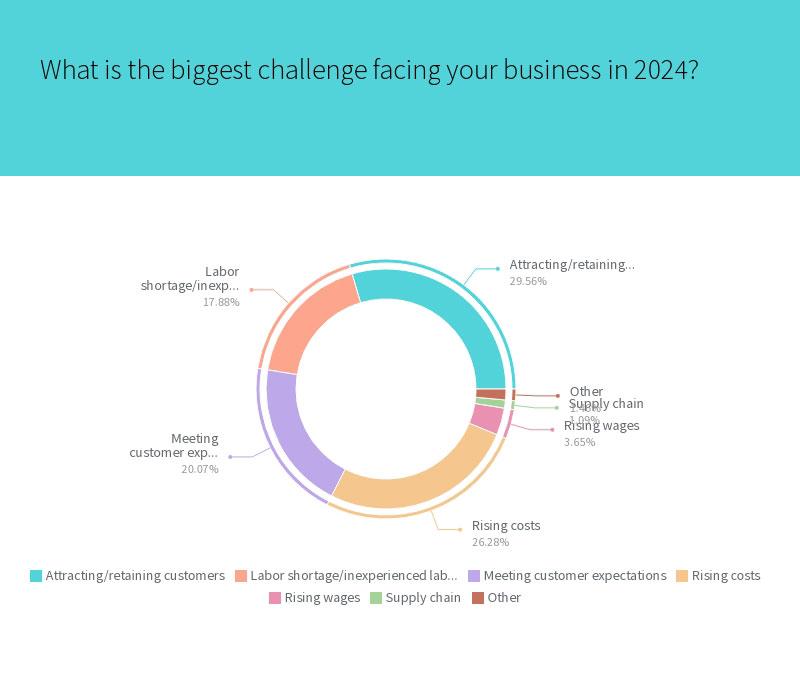

While rising wages didn’t rank high on the list of challenges facing operators, rising costs did (26.28%).

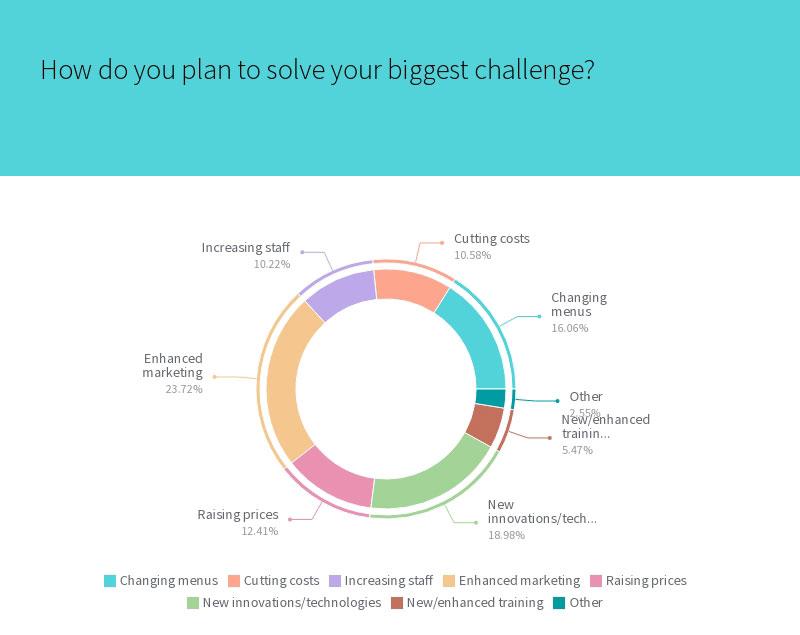

Operators cited investing in new technologies and innovations (another nod to AI here) as a possible solution.

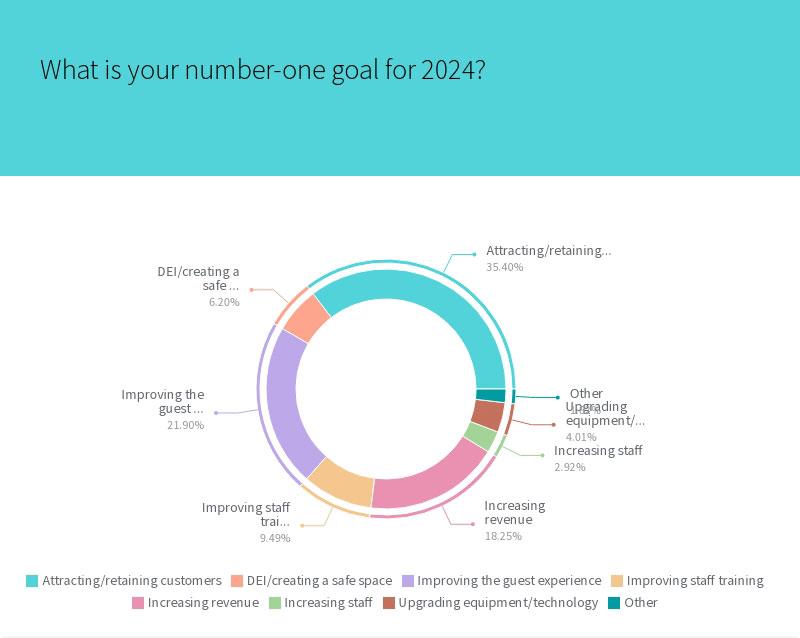

Facing pinches to the bottom line from multiple areas, another thing operators may want to consider is looking for ways to save—especially as the third highest goal for operators in 2024 (18.25%) was to increase revenue.

“Bars and restaurants must better prepare and position themselves for increased costs in today’s operational landscape,” says Doug Radkey, founder and president of KRG Hospitality Inc., a start-up and development consulting company. “The mindset should be about controlling costs, not necessarily finding ways to cut costs. There’s a significant difference between the two.”

Radkey suggested some ways to control versus cut costs, “Operators can control costs by putting updated strategic plans in place, along with updating their systems, processes, technology, and marketing strategies. Taking an honest look at your culture, providing consistent training, and reducing food waste also helps in controlling further costs. With each of those elements in place, operators can not only pay their people an above-regulated wage, but still drive positive cash flow and the profits they need to be financially sustainable."

Challenges Facing Bars & Restaurants in 2024: Customer Retention

Aside from costs, the top challenge cited by operators was attracting/retaining customers (29.56%). It was also the top goal for operators in 2024 (35.4%).

A related challenge, meeting customer expectations (20.07%) came in third, while improving the guest experience (21.9%) came in second for top goals in 2024.

Clearly, customer satisfaction is a concern for operators in 2024. For possible solutions, survey respondents said they would turn to changing menus (16.06%). They also cited food/drink quality (34.31%) and service (31.75%) as the top elements to focus on for a great guest experience this year.

However, the top solution for these challenges across the board was enhanced marketing (23.72%), with survey takers using Facebook (28.47%) and Instagram (22.26%) most for marketing.

Lauren Fernandez, CEO & founder of Full Course, an incubator and accelerator of early-stage food brands, recommends that bars and restaurants go beyond social to improve their marketing. “I would recommend a mix of tactics to attract and retain customers including email, retargeting ads, and loyalty messaging informed by past purchases,” she says. “Try to keep your brand top-of-mind when the next meal is on your customers' minds. Consider when and where a guest will be in their day when receiving your messaging. Add value to their day, don’t create unwanted disruption.

Let’s face it, if you’re scrolling your social feed at 11am when you’re just a mile from your favorite barbecue spot and a drool-worthy image of saucy ribs pops up,” she continues, “your lunch plans are pretty much set.”

Consumer Trends & Demands

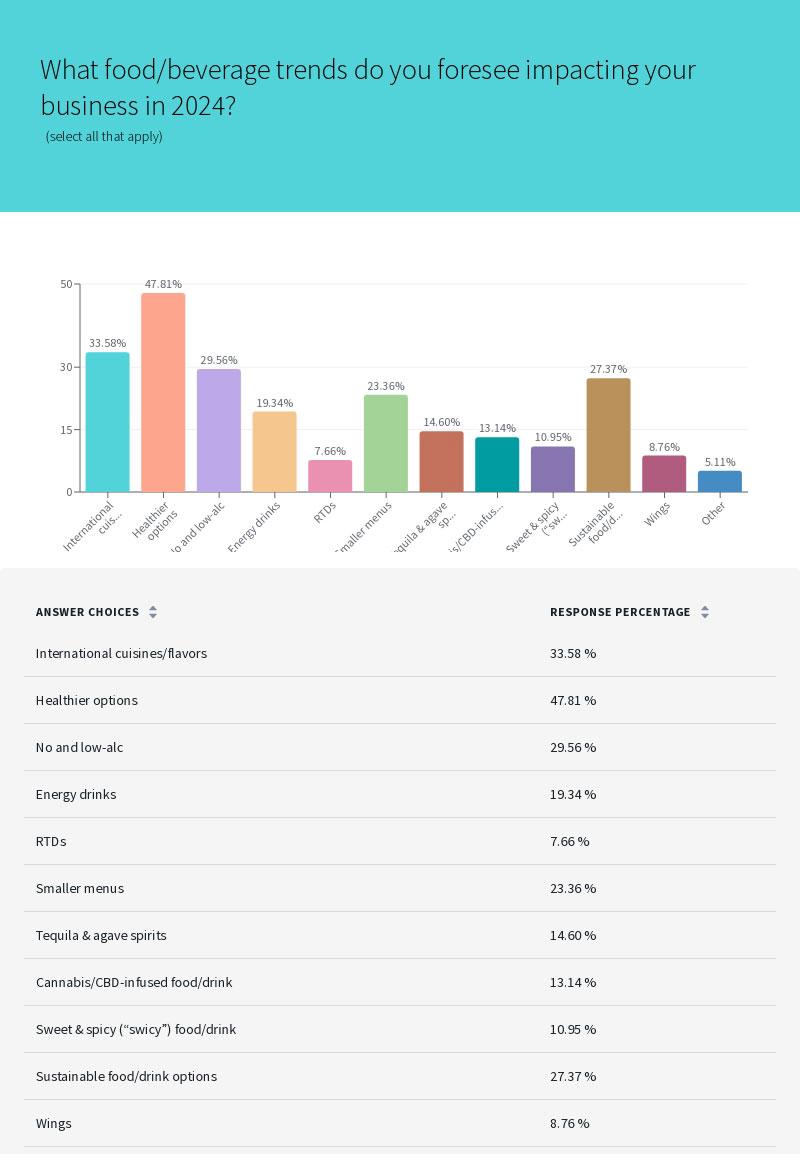

So, just what are customers expecting? Operators say they expect to see more demand for healthier options (47.81%) in the new year, as well as international cuisines and flavors (33.58%).

No and low-alc cocktails (29.56%) also ranked high on the list of expected trends. Over 80% of respondents said they offer non-alc cocktails, and of the remaining 20% that don’t, nearly half plan on adding them soon. For those not sold on non-alc, a lack of demand is driving their choice.

Unsurprisingly, it’s these expected trends and customer demands that drive spirit and food purchasing, with taste/quality of the product also playing a major role.

On the spirits side, vodka (25.55%), whiskey (14.6%), and tequila (13.14%) reign as the most popular spirits. Given the top cocktails—margaritas (14.23%), well drinks (12.04%), and Manhattans (11.31%)—this makes sense.

In food, wings, pizza, and burgers were all named as top-selling products. Operators also noted that they were likely to add more seafood and sustainable options to their menus in 2024.

Are you registered for our Crave and Crave on the Menu newsletters? Sign up today!

Plan to Attend or Participate in the 2024 Bar & Restaurant Expo, March 18-20, 2024

To learn about the latest trends, issues and hot topics, and to experience and taste the best products within the bar, restaurant and hospitality industry, plan to attend Bar & Restaurant Expo 2024 in Las Vegas.

To book your sponsorship or exhibit space at the 2024 Bar & Restaurant Expo, contact:

Veronica Gonnello (for companies A to G) e: [email protected] p: 212-895-8244

Tim Schultz (for companies H to Q) e: [email protected] p: 917-258-8589

Fadi Alsayegh (for companies R to Z) e: [email protected] p: 917-258-5174

Also, be sure to follow Bar & Restaurant on Facebook and Instagram for all the latest industry news and trends.